As a pet parent, you know how expensive pet care can be! Food, cat toys, litter, vet bills and pet insurance are just some of the things we pay for to make the lives of our furry friends happier. So wouldn’t it be great to get rewarded on all of those expenses AND be able to use them to help pay for the cost of veterinary care?

Well, you’re in luck because the Fursure Card sets out to do just that!

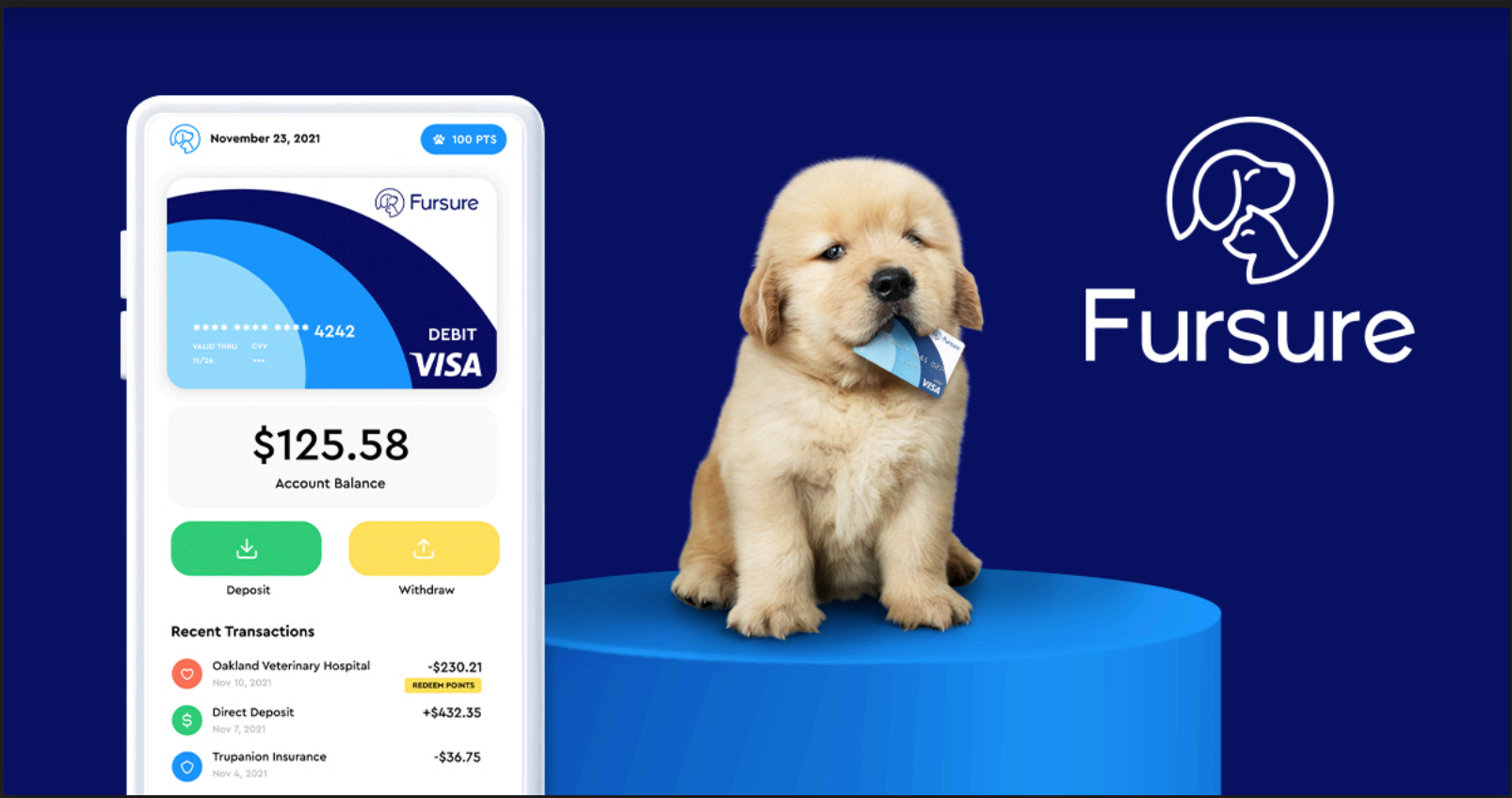

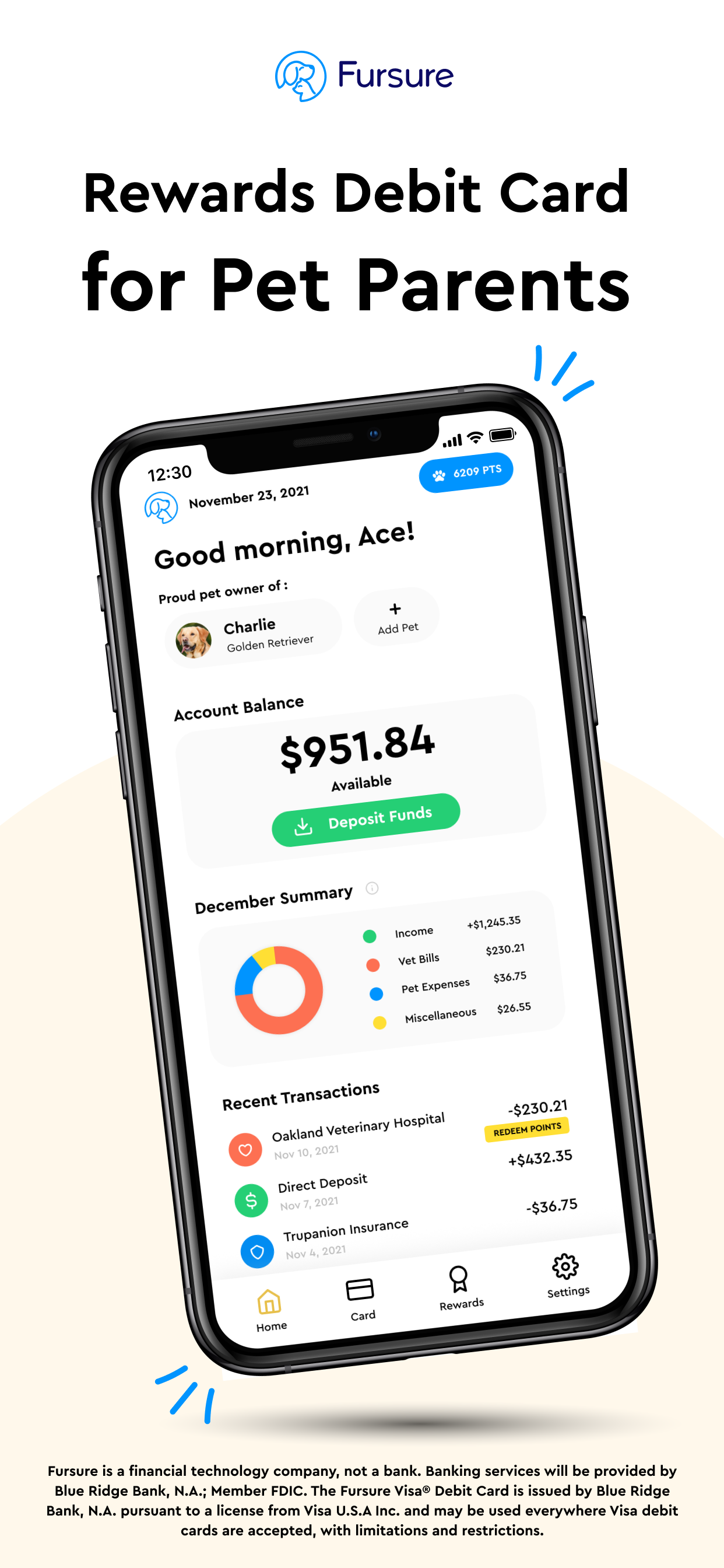

What is the Fursure Card?

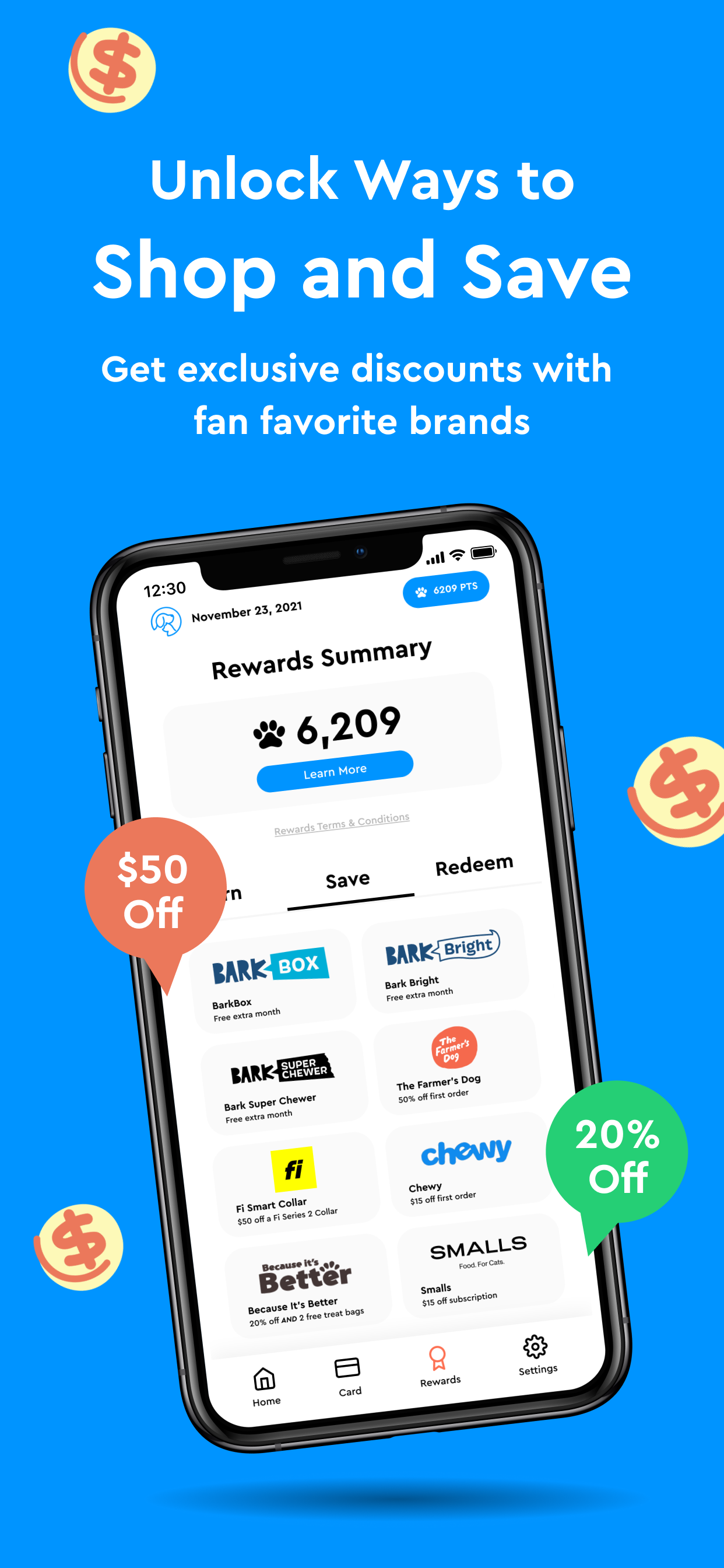

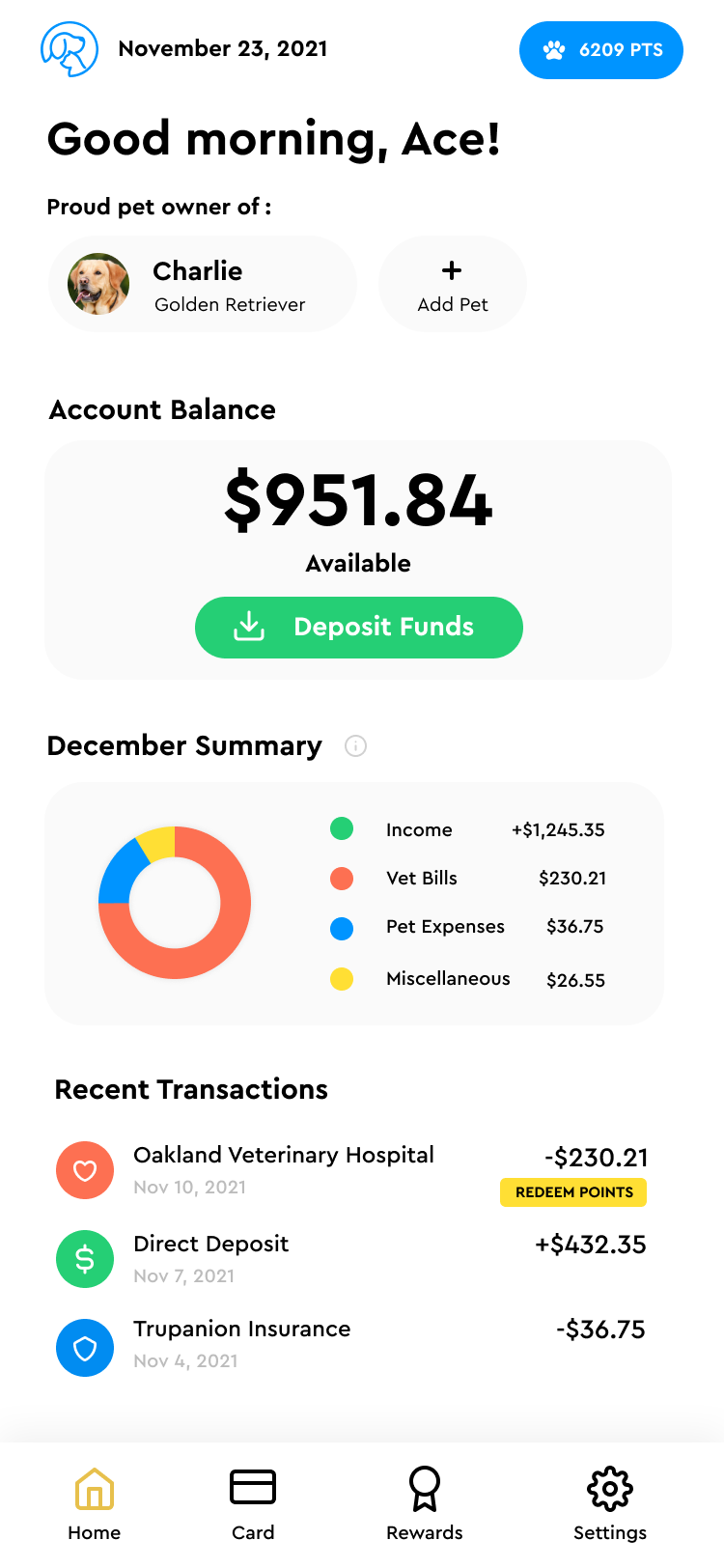

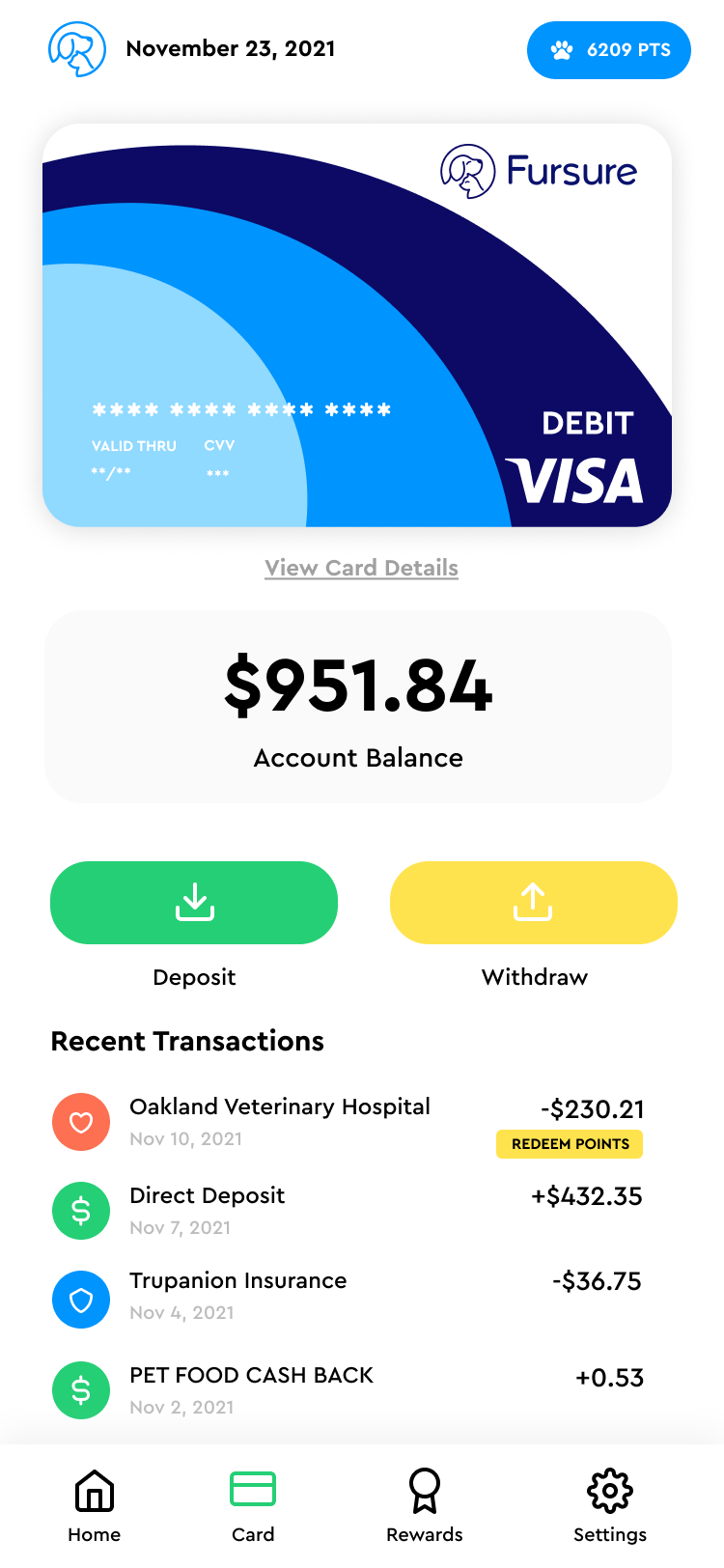

The Fursure Card is a rewards debit card that you can use to pay for all of your pet’s expenses as well as any other non-pet expenses and get rewarded for all of your everyday spend.

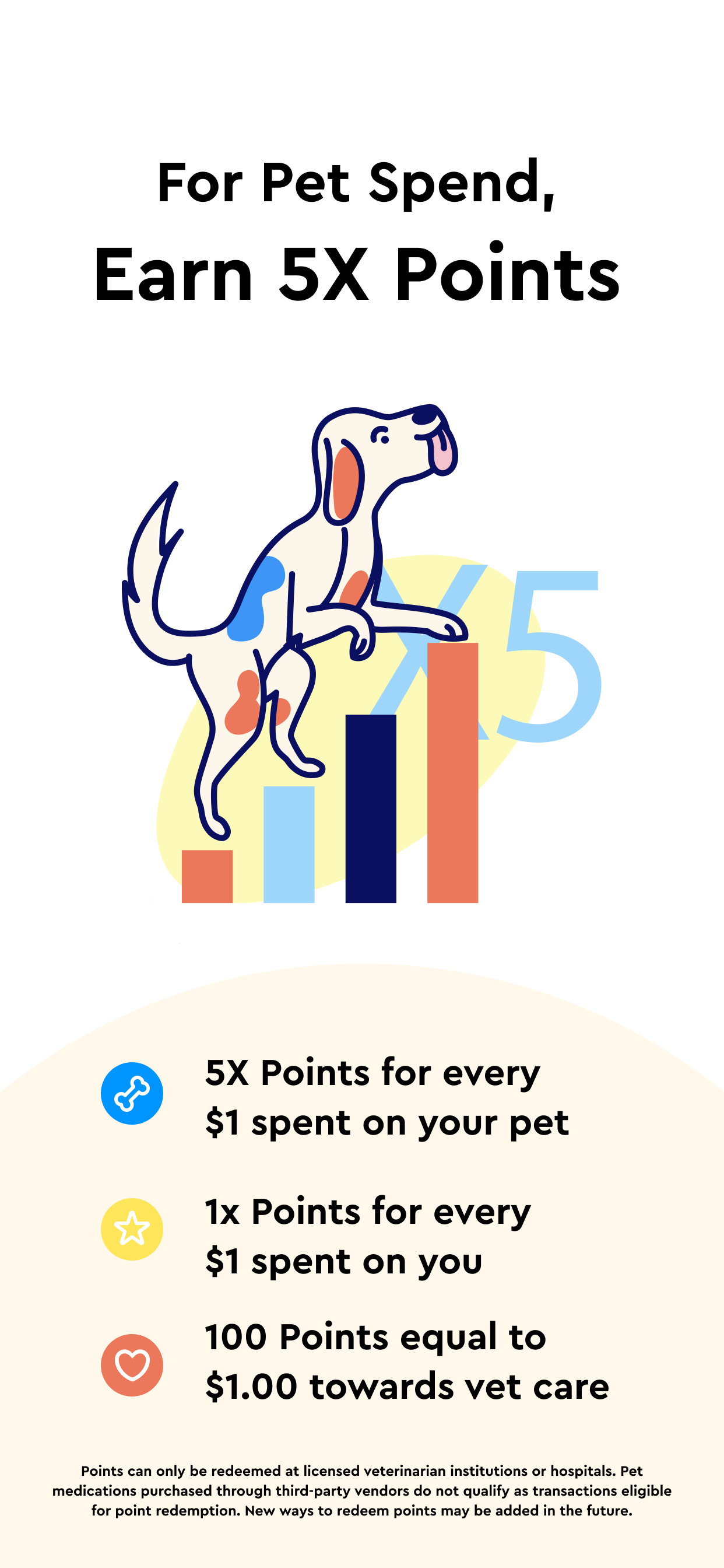

- Earn 5x points for every $1 spent on pet stuff

- Earn 1x point for every $1 spent on all the other stuff you buy

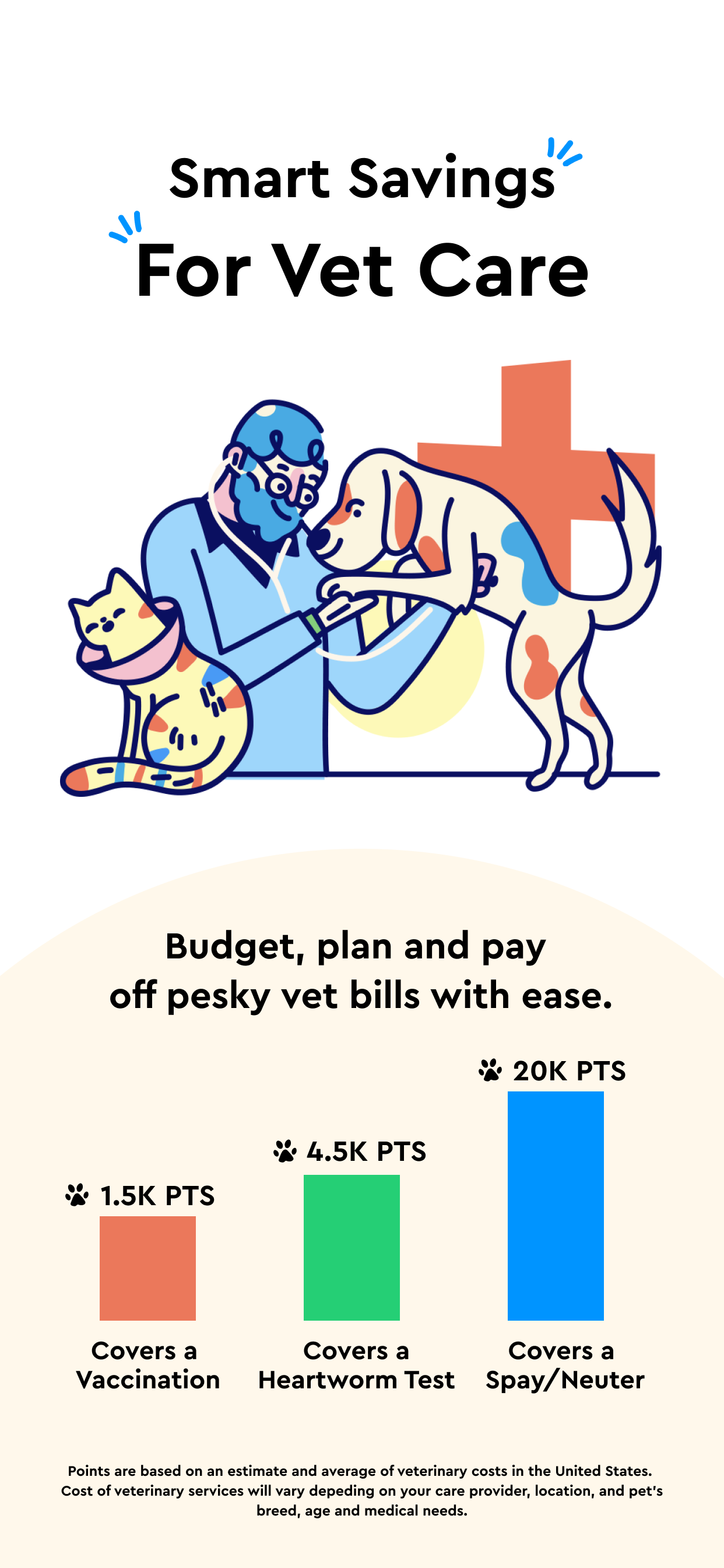

Your points add up over time and can be redeemed towards bills from licensed veterinary institutions and hospitals. Pet owners know that veterinary care can be extremely expensive, so being able to use your rewards to help pay for and/or offset this expense can be really helpful and a smart way to manage your finances.

Where Can I Use the Fursure Card?

You can use your Fursure Card just about anywhere online or in-person in the United States and anywhere that Visa® Debit Cards are accepted. There are no fees and no minimum deposit to open a Fursure Card and no transaction fees either*.

How Do I Earn Rewards with the Fursure Card?

You earn rewards points every time you use your Fursure Card. To maximize your rewards, be sure to use your Fursure Card on all of your expenses: pet-related and non-pet-related like:

Pet Stuff Earns You 5x Points

- Pet food

- Toys and accessories

- Grooming services

- Training

- Pet medications

- Veterinary exams

- Dental care and More

Pet expenses will earn you 5x the rewards points. For example, if you spend $100 on your pet in a month, you’ll earn 500 points for that spend.

Everyday Stuff Earns You 1x Points

- Rent

- Car payments

- Groceries

- Cell phone bills

Use it for all of your expenses to get the most of the card!

You can also use your Fursure Card for anything else you buy – groceries, gas, shopping and anything else you buy with your Fursure Card. You’ll earn $1 for every $1 you spend on everything else. For example, if you spend $1,000 on all of your non-pet expenses per month, you’ll earn another 1,000 points!

Plus Get 8x Points Supercharge!

The Fursure Card also has “supercharged” points where you’ll earn 8x points at retailers like Amazon and Target. Watch for rotating “supercharge” offers on a variety of retailers and spend categories!

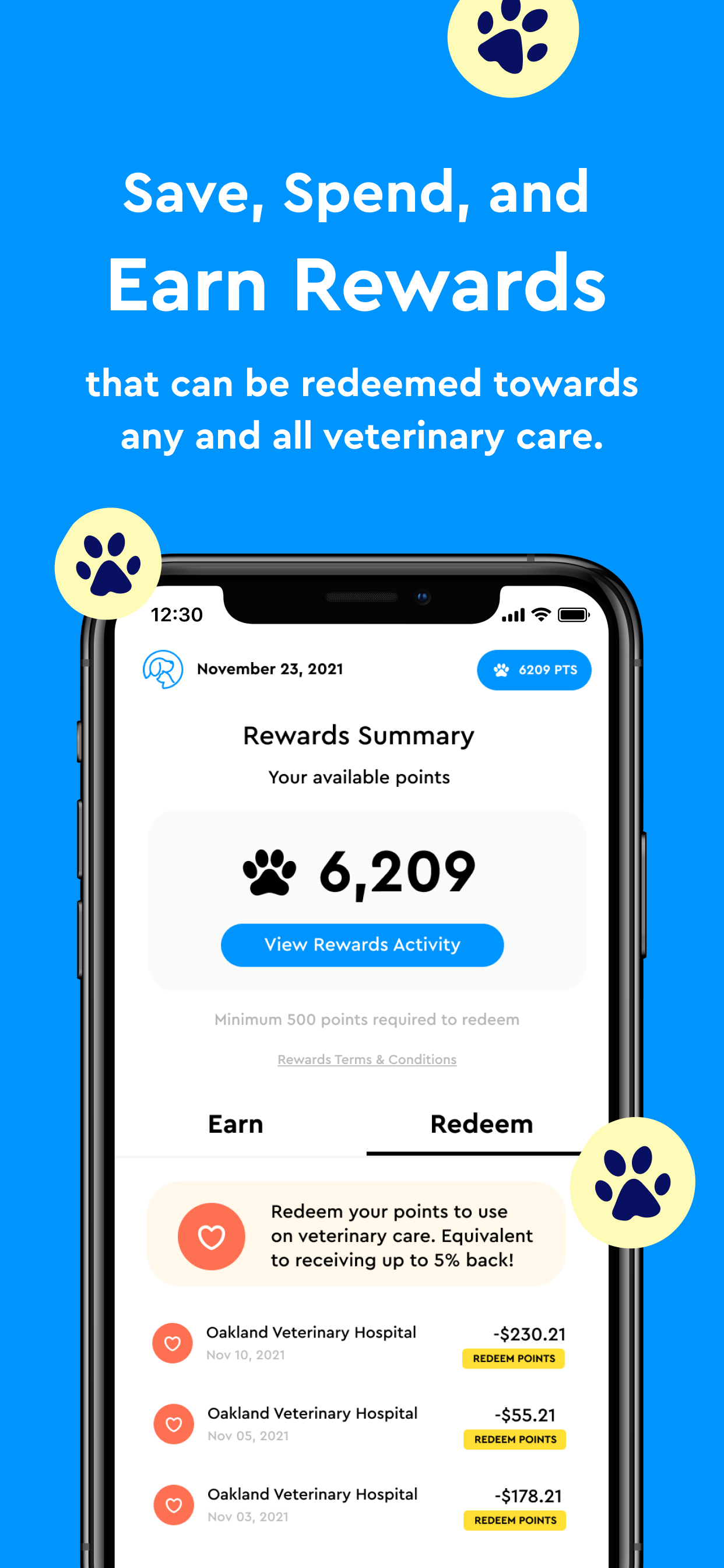

What Can I Use My Points For?

You can use the rewards points you earn on costly veterinary bills. Every 1,000 points is equal to $10 that can be used to pay off veterinary expenses. When you use the Fursure Card for all of your purchasing, the points add up fast! For example, earn 10,000 points and get $100 towards your vet bills.

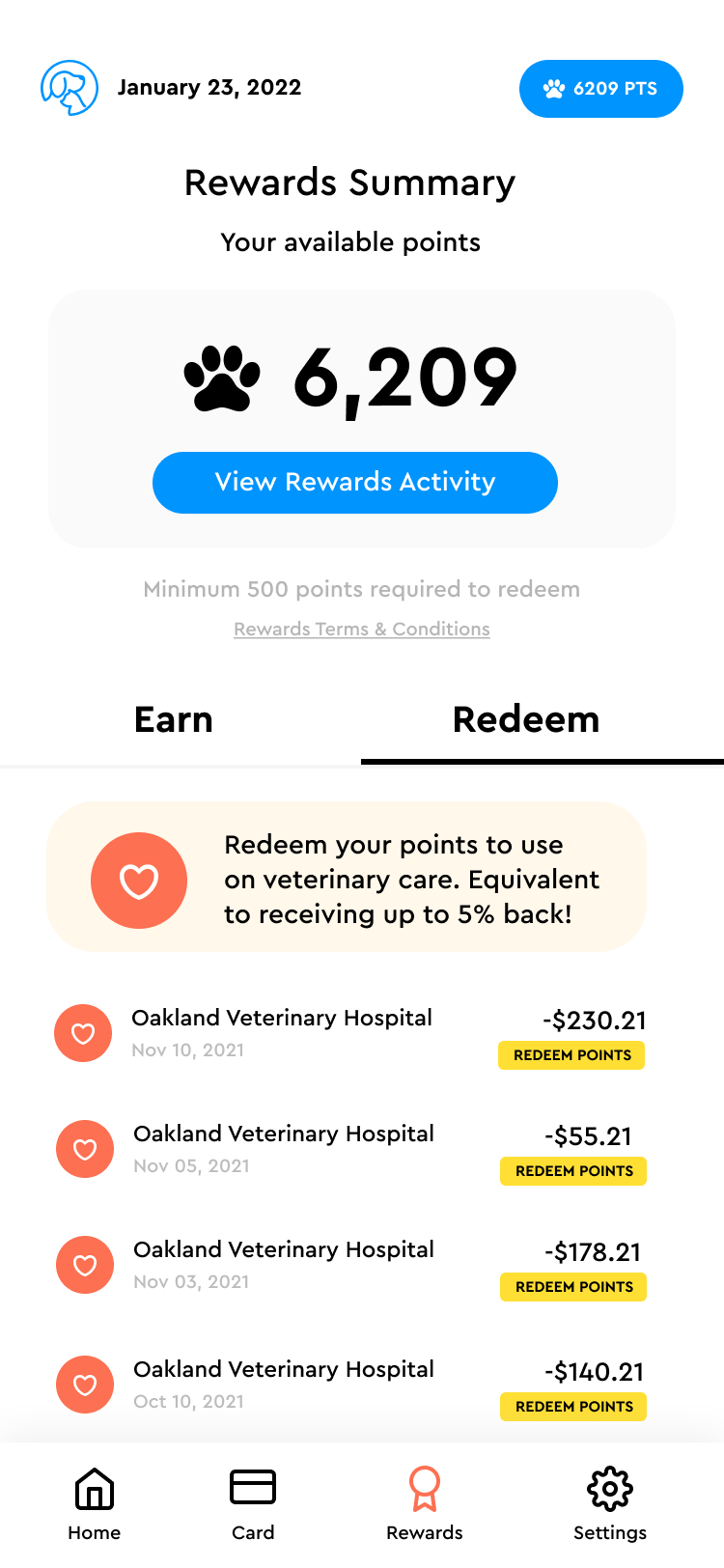

How Do I Redeem My Points?

Redeeming your points is easy! In your Fursure Card app, you’ll do the following:

- Click on the “Rewards” menu item at the bottom of the app screen

- Then, select the “Redeem” button in the middle of the page to be directed to a list of your previous transactions

- Select the veterinary expense you’d like to apply your points toward

- Click on the veterinary bill to redeem points to help cover that expense

- Confirm your selection. You will be directed to a confirmation page where you will confirm that you wish to apply your points towards your selected transaction.

- Choose the number of points you want to redeem. You can select up to the total amount of points you have available in your account, up to the equivalent dollar amount of the bill.

- Fursure will deposit that amount into your account, and decrease your points accordingly.

Once you click “Confirm” at the bottom of the app page your bank account will be credited within a maximum of 14 business days.

How Do I Get A Fursure Card?

Simply apply for a card online. There are no fees and no credit checks. Once approved, you’ll receive a virtual card to keep in your virtual wallet and you can also request a free physical card as well.

Who Backs The Fursure Card?

Banking services for the Fursure Card** are provided by Blue Ridge Bank, N.A., member FDIC. Blue Ridge Bank is a financial institution that is both secure and FDIC-insured up to $250,000; so you can feel safe knowing that they are a legitimate bank.

To apply for a free Fursure Card click here.

The Fine Print:

*Note that some merchants may charge fees or a surcharge and but most do not.

**Fursure is a financial technology company, not a bank. Banking services will be provided by Blue Ridge Bank, N.A.; Member FDIC. The Fursure Visa®️ Debit Card is issued by Blue Ridge Bank pursuant to a license from Visa U.S.A Inc. and may be used everywhere Visa debit cards are accepted, with limitations and restrictions.

The Catnip Times was paid a fee in exchange for advertising this product.